Mifos user manual

How to define new loan products

- How to waive interest on early loan repayment

- How to configure variable loan installments

- How to use multicurrency features

In Mifos, a loan product is a type of loan account. A single MFI typically has several loan products--for example, a 4-year housing loan, and a 2-year educational loan. The product provides the terms and definitions of these different programs to the Mifos system. Loan products are available to the whole MFI.

If a customer wants to borrow a 2-year educational loan, the MFI uses the 2-year educational loan to create an account for the customer. The loan account is used to track transactions related to the loan, which include interest, repayment, and any applicable charges. The loan account is a specific instance of a loan product, with a specified interest rate and an account number, and it is owned by a specified MFI customer.

For example, Rashmi and Shalini might both have loans for income-generating businesses. They are separate accounts (they have different account numbers and different balances), but both loans are instances of the same product (they were authorized by loan officers under the same program and share common traits, such as the way that the proceeds are used, the way interest is calculated, and the general ledger entries they are posted to). Although the terms of a loan account are governed by the product definition, the loan officer may have some flexibility to change interest rates and other attributes. Therefore, many of the properties of a loan product define the minimum and maximum values that the user may choose when an account of that type is opened.

The purpose of a product is as follows:

- To offer MFI personnel a menu of choices of predefined services to offer clients, and the range of legal parameters where variation is permitted.

- To define a link to the accounting system, so that disbursements and receipts can be credited to the proper general ledger account.

- To provide a grouping of different accounts that should be combined for reporting purposes. Before you can make individual loans, you must define a loan product. All individual loans created from the same product have the same basic attributes.

Note: If you want to see the loan products that have already been created before you make a new one, click Admin > View Loan Products and click any of the products displayed on that screen.

Follow these instructions:

- Click Admin > Define New Loan Product.

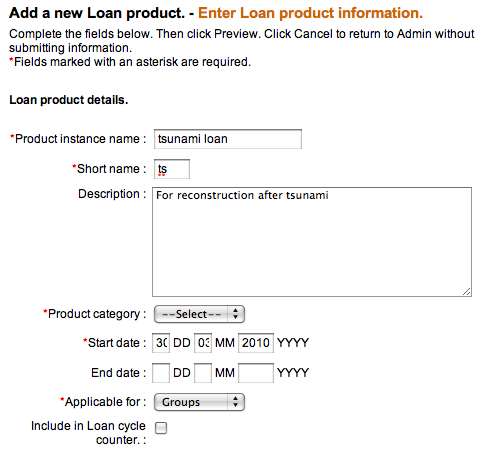

A screen appears with all the specifications for the product. The first part of the screen looks like this:

- Enter information using the descriptions in the following table:

|

Field name |

Description |

|

Product instance name |

The full name of the loan product being defined. |

|

Short name |

An abbreviated version of the name, used in reports or menus where space is limited, such as Collection Sheets. |

|

Description |

A description of the loan product: its purpose, eligible recipients, or other information that will help an employee determine whether it is appropriate for a particular client. |

|

Product Category |

A selection from the list of all the active loan product categories. Products not assigned to any category are assigned to the Other category. |

|

Start Date |

The full date after which loans of this type may be issued. |

|

End Date |

The last date on which loans of this type may be issued. |

|

Applicable For |

Click whether this is a loan given to groups or individual clients. |

|

Include in Loan Cycle Counter |

A Yes/No choice for whether these loans count towards the experience level of this borrower. The default option is Yes. |

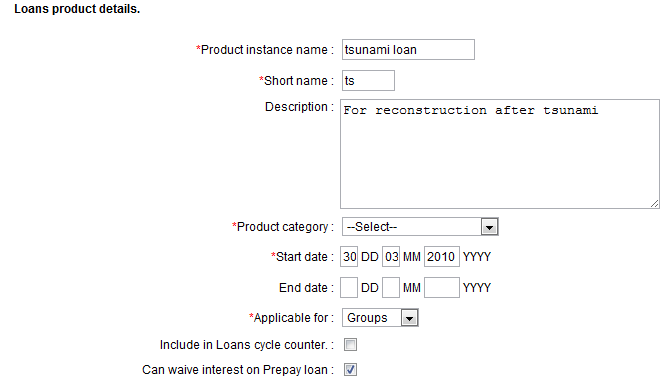

An additional field titled 'Can waive interest on Prepay Loan' is displayed. Information on its significance and how the feature can be enabled is discussed in the next section.

Waive Interest on Loan Repayment

Mifos provides MFIs the option to waive interest during repayment of certain Loan products. In some cases, this is used to reward clients who repay loans earlier than the required date. When MFIs exercise this option to waive interest for a certain product type, clients repaying loans of that specific product type are not charged interest for the current active instalment. Otherwise, when a client repays a loan, interest is captured for the current active instalment as well.

If the option to waive interest is not enabled, the loan amount due is calculated as follows:

Amount due =

All installments unpaid + Current installment due + Future Principle amounts only.

This feature can be specified for new as well as existing loan products.

To enable feature for new loan products: Follow steps detailed in above section to define new loan product. To select the 'Can Waive Interest on Prepay Loan' option for the loan in question, mark the corresponding check box as shown below.

By default, this feature is not enabled.

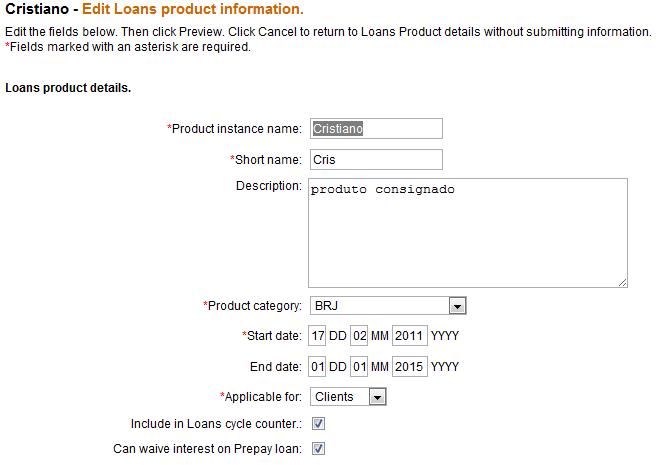

To enable feature for existing loan products: Select the existing loan product for which the interest needs to be waived. To do this, follow these instructions:

1. Click Admin> View Loan Products (under Manage Products> Manage Loan Products)

The following screen with the list of loan products created will be displayed.

2. Click on the loan product that you'd like to modify. On click of that product, the product details are visible.

3. Click Edit Loans Product Information (top right). All the fields are visible in edit mode. Mark the Can waive interest on Prepay Loan option as shown below.

4. Click the Preview button to check if the changes have been made. The Can Waive Interest on Prepay Loan field should now read Yes.

5. Click Submit.

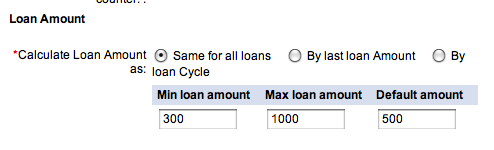

The next section deals with the amount of the loan. If you have multiple currencies configured for loan products, you can select the currency that the loan product applies to.

Enter information using the descriptions in the following table:

|

Field

|

Description

|

Example

|

|

Calculate Loan Amount

|

The way the loan should be calculated:

Same for All Loans: The loan amount does not vary, and the loan history is not taken into consideration.

By Last Loan Amount: The loan amount depends on the amount of the last loan this client or group received. After a successfully repaid loan, the amount of money available for the next loan increases.

By Loan cycle: The loan amount depends on the experience of the borrower (prompt or late repayment, for example) with previous loans. The larger the number of successfully repaid loan cycles, the larger the amount of money available for the loan.

|

Same for All Loans

|

|

Min Amount |

The smallest amount that a loan of this type may be granted for. |

50

|

|

Max Amount |

The largest amount that a loan of this type may be granted for. |

300

|

|

Default (Standard) Amount |

The typical amount that a loan of this type may be granted for. |

150

|

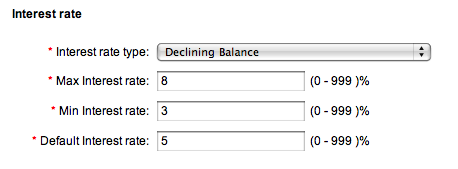

The next section deals with interest rates. The loan product sets up a range of interest rates; a manager can specify a rate within this range for an individual loan instance.

Enter information using the descriptions in the following table:

|

Field name |

Description |

|

Interest Rate Type |

The formula used to calculate interest due, based on the amount of money borrowed. For example, the Flat rate sets the interest due as the product of the principal times the interest rate times the full term of the loan. The amount can be paid all at once or distributed throughout the loan period. The Declining Balance rate charges interest on the outstanding loan at the end of the instalment period. As the loan amount decreases, the interest due decreases as well. The Declining Balance—Equal Principal Instalment is like the Declining Balance type, except that the borrower pays equal instalments of principal for the duration of the loan, and the interest is calculated on principal that has not been paid for the loan period. The Declining Balance - Interest Recalculation method calculates interest based on early or late and/or partial or excess payments. Installments are equal throughout the loan with the recalculation factored into the allocation between principal and interest for each installment. |

|

Max interest rate |

The maximum interest rate that can be charged with this loan product. |

|

Min interest rate |

The minimum interest rate that can be charged with this loan product. |

|

Default interest rate |

The standard interest rate that is charged with this loan product, if you do not make any changes to the rate. |

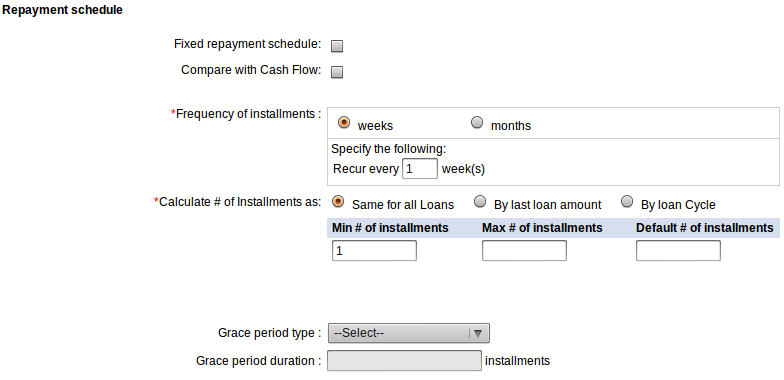

The next section deals with the installments of the loan.

Enter information using the descriptions in the following table:

|

Loan product attribute |

Description |

Example |

|

Frequency of Instalments |

The frequency the payments are made to the MFI. In the Recur Every Box, type the number of weeks or months in each instalment. |

Every week |

|

Calculate # (number) of Installments |

Click one of three choices:

By last loan amount : The number of instalments depends on the amount of the last loan this client or group received. By loan cycle : The number of installments depends on the experience of the borrower (prompt or late repayment, for example) with previous loans. |

|

|

Max # of Installments |

The maximum number of installments in which the loan can be repaid. |

20 |

|

Min # of Installments |

The minimum number of installments in which the loan can be repaid. |

10 |

|

Default # of installments |

The default value entered in the number of installments when defining a loan account. The user will be able to change the installments value when defining a loan account based on this loan product. |

15 |

|

Grace Period Type |

An initial grace period is the time between the disbursal date of a loan and the collection of the first regular payment. Click one of the following choices for the type of extra time allowed for repayment: None : No extra time is allowed. Grace on All Repayments : The client is not required to start repayment until the grace period ends, and interest is not charged during this period. That is, extra time is given for both principal and interest. Principal-only Grace : Extra time is allowed only for the principal, not the interest of the loan. The client must make regular interest payments but is not required to make payments against the principal during the grace period. |

Grace on All Repayments |

|

Grace Period duration (instalments) |

This is the number of initial due dates at the beginning of the loan when no payment is due. The first payment would be due on the next instalment date. |

3 (first payment due at period 4) |

How to create Variable Installment Loans

Overview: Often times, MFIs face the need to tailor loan disbursement, loan repayment recovery and loan maturity to suit the cash flow patterns of the borrower. This is especially true of products like agricultural loans where clients repayments can be quite volatile. The volatility arises due to increased vulnerability of the agricultural industry to factors like inclement weather. Consequently returns in such sectors are seasonal, unpredictable and often lower than those of the regular commercial enterprises for which MFIs disburse loans. This necessitates the need for MFIs to have customized loans products, which allow for more flexibility with the installment schedule.

The Variable Installment Loans feature of Mifos enables MFIs to accommodate this flexibility by specifying different gaps between installments, as explained in the How to Manage Variable Loan Installments section.

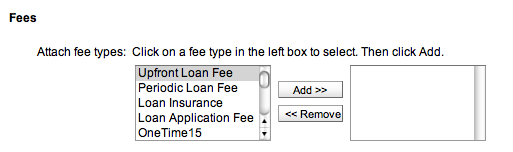

The next section deals with any fees that are attached to this loan.

- In the box on the left are all fees currently defined in Mifos. The box on the right contains any fees applied to this loan. Click any fee on the left and then click Add>> to move it to the box on the right. You can add more than one fee to this loan product. To remove the fee from this loan product, click it in the box on the right and then click <<Remove.

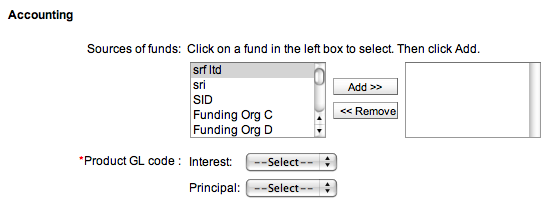

The next section deals with accounting details for the loan product. These details are sent to an external accounting application to keep track of the sources of funds and general ledger processing (interest/principal).

- In the box on the left are all funds currently defined in Mifos. The box on the right contains any funds used as sources for this loan. Click any fund on the left and then click Add>> to move it to the box on the right. You can add more than one fund to this loan product. To remove the fund from this loan product, click it in the box on the right and then click <<Remove.

- The Product GL Code refers to general ledger codes set at the time of configuration. Every transaction has a corresponding GL code for further financial tracking. To apply a GL code to the interest for this loan product, click a code in the Interest list. To apply a GL code to the principal for this loan product, click a code in the Principal list.

- When you are done setting up the loan product, click Preview to review your work.

- If you want to make changes. click Edit Loan Product Information and make changes.

- When you are satisfied with all the details, click Submit. (If you decide not to create a loan product at this time, click Cancel.)

How to use multicurrency features

If Mifos has been set up in configuration to handle more than one currency, then when you define a new loan product, you can keep the default currency or specify an additional currency. The same choice appears when you define new fees. All loan accounts created from a loan product use the currency defined for that product.

When you create the new loan product, a currency field appears in the Loan Product Details section, as shown here:

All fees associated with that loan product must also use the same currency.

When the user chooses a loan product to create a loan account from, the currency for that product appears in the definition of the product.