Mifos user manual

How to apply fees/charges

Your MFI can charge fees for any service, such as membership and loan processing. These fees and charges can be collected from centers, groups, and clients and assessed on loan accounts. To apply charges, follow these instructions:- If the fees are for the services provided to a center, group, or client, in any Search box, type the name of the center, group, or client and click Search. In the list that appears, click the link for the correct one. In the details page that appears, in the Account Information and Center/Group/Client charges section, click View Details and then Apply Charges.

- If the fees are for a specific loan account, in any Search box, type the ID for the account and click Search, or navigate to that account from the center/client/group details page. Click the link that appears for that loan. In the details page that appears, in the Transactions box in the upper right corner, click Apply Charges.

- Click Apply Charges. A screen like the following appears:

- In the Select Charge Type list, click the appropriate charge. If there is a set amount for this charge, it appears in the Amount box.

- In the Amount box, type the amount to apply.

- Click Submit.

The charge now appears in the Upcoming Charges and the Recent Account Activity list. It will appear in Transaction History when posted.

Early Repayment of Fees

This feature provides MFIs the ability to collect fees in advance of the repayment date. However, early repayment of fees is applicable only at the client, group and center level. It cannot be applied to loan accounts.

This feature, part of Mifos 2.1, enables fees to be assessed and collected up-front at the time in which they've been assessed. Specifically, this feature could be used by MFIs to charge a fee for withdrawal from a savings account. Currently, Mifos does not provide any option to assign penalties or fees to a savings account. If your MFI has a business need to charge fee for withdrawal from a savings account, the early fee repayment feature can be used to assign and charge that fee at the client level (as described in the section below).

When an early payment is made, it is paid off in the following order:

- Overdue charges

- One-time fee

- Recurring fee

In general, fee repayment can be entered into the system in two ways:

- Through the Apply payment option for a client/ center/ group.

- Through Collection Sheet Entry

The Apply payment feature can be used to collect fee payment before the meeting, on the day of meeting and back-dating of meeting.

Collection Sheet Entry cannot be used to make an early repayment of fee for a meeting date which has not occurred yet . It can either collect payments on the day of the meeting or it can be used to collect back-dated payments before the next meeting date.

The next section describes the process of applying fee repayment through apply payment and collection sheet entry.

For each of the below scenarios, let's assume the following scenario: The entity (client, group, or center) has a monthly meeting date of Dec 5. You would like to apply and collect a fee either before this meeting date or on the day of the meeting.

Without the early repayment capability, any fees applied wouldn't be able to be collected until the next meeting date.

| Action: | Without Early Repayment of Fees | With Early Repayment of Fees |

| Apply and collect payment of fee on Dec 1 (early) |

Apply Payment: Fee can be applied prior to meeting but not collected until Dec 5. Collection Sheet: N/A |

Apply Payment: Fee can be applied prior to meeting and collected on Dec 1. Collection Sheet: N/A |

| Apply and collect payment of fee on Dec 5 (day of meeting) |

Apply Payment: Fee can be applied to account but not collected till next meeting, Jan 5. Collection Sheet: Fee will not show up as due under A/C column until next meeting for Jan 5. |

Apply Payment: Fee can be applied to account and collected on Dec 5. Collection Sheet: Fee will show up as due under A/C column for meeting on Dec 5. |

The steps below outline in detail the process you would follow to complete each of these scenarios.

Additional scenarios including back-dating of fees are covered in detail on the Early Repayment of Fees functional specification.

Early fee repayment through apply payment:

When a payment is made at the center/group/client level, the payment applies only to fees. The sections below describe how early fee repayment can be made through apply payment feature.

Early fee repayment at the Center Level

When a payment is made at the center level, the payment applies only to fees. To make an early fee repayment at the center level, select the center for which the fee needs to be collected. This can be done as follows:

1. In any search box type the name of the center for which you want a fee applied and click Search. The center(s) matching the search string you provided will be displayed. The page will look something like this:

2. Select the required center. A screen similar to the following will be displayed:

3. Under Center Charges in the Account Information section displayed above, click View Details. A screen with the following sections is displayed:

Apply transactions - This section allows the user to enter loan repayment details (apply payment), modify entered loan repayment details (apply adjustment) and apply charges to the center like fee, penalty, etc (apply charges).

Account Summary - This sections shows the amount due at the next installment, the amount overdue (unpaid at the previous installment) and the total.

Upcoming charges - This section shows the charges that are due at the next repayment schedule.

Recent Account Activity - As the name suggests, this section shows all recent activity by the center.

4. Click Apply Payment. This leads to a screen similar to the following:

Date of transaction - This records the date of the transaction. By default, it is set to the current date.

Amount - This is amount of fee that is being repaid.

Mode of payment - This is the mode in which repayment is made. Typical modes include Cash, Voucher, Cheque and MPESA.

Receipt ID - If a receipt ID is used, it is entered here.

Receipt Date - The receipt date, if a receipt was used, is entered here.

5. Enter the amount of fee repaid. When payment is made, it is applied in the following order: all overdue charges are applied first followed by one-time fee followed by recurring fee.

6. System validations and other notes: When an amount is entered, the system performs the following validations.

- The amount entered should not be greater than the total fee owed by the client. In case the amount exceeds, the system throws an error message.

- The amount repaid can be less than the amount expected for that period. In this case, the system simply transfers the remaining unpaid amount towards the next payment (assessed as overdue charges)

- In the case of repayment of savings penalties too, if an amount less than the expected amount is repaid, the system simply considers it as a partial repayment of penalty. The balance amount now appears as the opening balance to be repaid by the client at the next meeting. Any amount greater than the required savings penalty is applied against fee repayment, if any. If there is no fee due, then the system throws an error for repayment of an amount greater than the expected amount.

- As mentioned above, the fee payment is applied in the following order:

- Overdue charges

- One-time fee

- Recurring fee.

So, when a fee payment is made all overdue charges are repaid first. The remaining balance is adjusted against the one-time fee. If some balance still remains, it is adjusted against the number of recurring meetings for which the fee can be repaid.

Example: If overdue charges = 5, one-time fee = 10 and recurring fee = 2 for a period of 5 installments. Suppose the client makes a repayment of 19, then the amount is adjusted in the following manner.

- Overdue charges totalling 5 are repaid first. So, the remaining balance is 19-5 = 14.

- The one-time fee of 10 is repaid next. Remaining balance = 14-10 = 4

- The balance of 4 can be applied against 2 schedules of recurring fee. The balance remaining is now 0.

- The fee amount owed by the client is now equal to the remaining recurring fee (2 * remaining 3 installments = 6). This amount is displayed by default as the opening balance amount to be repaid by the client.

For more scenarios and examples, please look up documentation available here.

7. Click Review Transaction and if you are satisfied with the updates, click Submit. Else, click the Edit button and modify the transaction details.

Early fee repayment at the Group Level

When a payment is made at the group level, the payment applies only to fees. To make an early fee repayment at the group level, select the group for which the fee needs to be collected. There are two ways you can do this:

1. As mentioned in the section "Early repayment at the Center Level", in any search box enter the name of the group and click Search. The group(s) matching the search string provided are displayed. Select the required group.

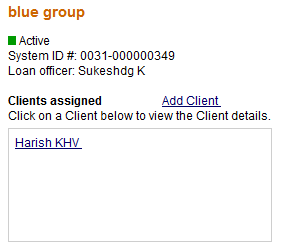

2. Alternately, if you know the center to which the particular group belongs, select the center as described in the previous section. A screen like this will be displayed, with the list of groups assigned to the Center.

Select the required group. The rest of the procedure is the same as described for the Center. Follow steps 3-5 outlined in the previous section "Early fee repayment at the Center Level".

The validations performed at the group level are also similar to that at the center level.

Early fee repayment at the Client Level

This is very similar to what has been outlined in the above two sections. The client can either be located through a search or by selecting the group to which the client belongs and then selecting the client from that group. In the case of the latter, a screen similar to the following is displayed. The client can then be selected from the list of clients assigned.

After selecting the client, follow steps 2-5 outlined above for the remaining process of applying an early fee repayment at the client level.

The validations performed are similar to that at the center level.

Note: In case a particular client has both penalty and fee due, then the repayment is applied in the following order: penalty is repaid first and if there is excess balance, the fee is repaid.

Early fee repayment through Collection Sheet Data:

The collection sheet is set up to make your collections easy. After you type in the information for the branch, loan officer, date and mode of payment, you see a form that already includes all payments and deposits that are expected on that date.

As already mentioned, collection sheet entry cannot be used to make early repayment of fee for a meeting which has not occurred yet. It can only be used to make payment on the day of the meeting or back-dated payments before the next meeting date.

If unfamiliar with using Collection Sheet Entry, please visit the How to enter collection sheet data section of the User Manual.

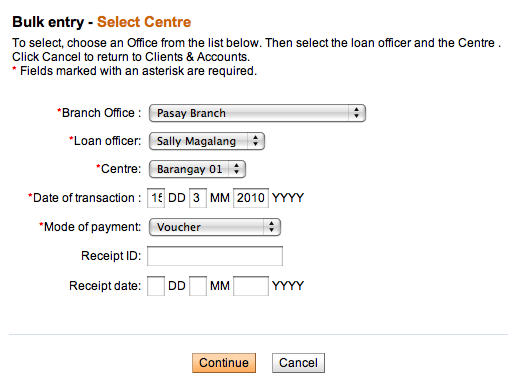

To access the collection sheet entry page, click Clients and Accounts > Enter Collection Sheet Data and a screen similar to the following will be displayed:

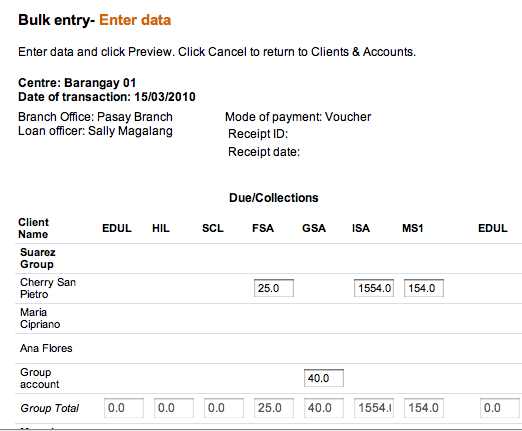

- Once you've clicked through Continue, a screen appears summarizing all the accounts at this branch whose collections fall on the day you specified. It might look like the following:

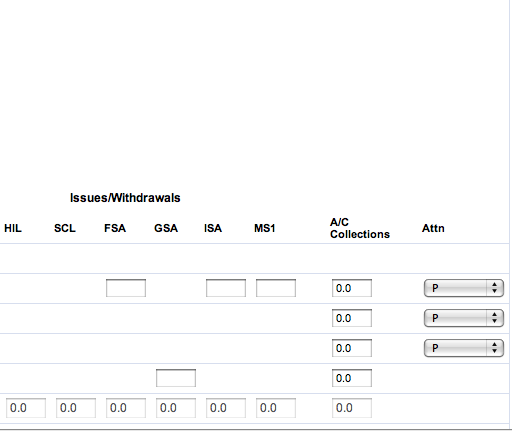

- The relevant fields for applying fees will be in the following columns:

- To enter the early fee repayment for a particular client/ group/ center, enter the respective fee amount against that client/ group/ center under the A/C collections column. This field is pre-populated with the list of charges/ fee assessed against the client/ center/ group. Enter the fee amount repaid by the client. A validation is performed by the system to make sure the amount entered is not greater than the fees due.

- To enter penalty for withdrawal against a savings account at the client level, enter the required penalty amount against the client in the A/C collections column. The field is pre-populated with the required penalty amount.

- Note: Loan fees (which don't have the early repayment capability) will show up under Due/Collections containing the short names of each loan and/or savings product appear.

To understand the capability of the new early repayment of fees features, let's revisit our original example. Assume you have a client whose monthly meeting date is Dec 5. On Dec 5 (the day of the meeting) you would like to assess a client fee of 10. You manually apply the fee to the client. In the Collection Sheet Entry page for Dec 5, this fee of 10 will show up under the A/C collections column.

Prior to the early repayment of fees functionality, after applying the fee manually to the client on Dec 5, this would not show up on the Collection Sheet Entry page until the next meeting date of Jan 5.

- System validations and other notes: When an amount is entered, the system performs the following validations.

- The amount entered should not be greater than the total fee owed by the client. In case the amount exceeds, the system throws an error message.

- The amount repaid can be less than the amount expected for that period. In this case, the system simply transfers the remaining unpaid amount towards the next payment (assessed as overdue charges)

- In the case of repayment of savings penalties too, if an amount less than the expected amount is repaid, the system simply considers it as a partial repayment of penalty. The balance amount now appears as the opening balance to be repaid by the client at the next meeting.

- As mentioned above, the fee payment is applied in the following order:

- Overdue charges

- One-time fee

- Recurring fee.

However, in case of collection sheet entry, only payments on the meeting date or backdated payments before the meeting date is allowed.Recurring fee payment for a meeting date which has not occurred yet is not allowed. Only backdated recurring fee for an already elapsed period or recurring fee for the current meeting date is allowed.

So, in the case of repayment through CSE, when a fee payment is made, all overdue charges are repaid first. The remaining balance is adjusted against the one-time fee, provided the repayment date is for a period already elapsed or if repayment is scheduled for the current meeting date. Recurring fee for future meeting dates are not accepted by the system.

Example

: If overdue charges = 5, one-time fee = 10 repayable on the first installment meeting and recurring fee = 2 for a period of 5 installments. Suppose the client makes a repayment of 19 on the meeting date of the first installment, then the amount is adjusted in the following manner.

- Overdue charges totalling 5 are repaid first. So, the remaining balance is 19-5 = 14.

- The one-time fee of 10 is repaid next. Remaining balance = 14-10 = 4

- The balance of 4 can be applied against only 1 schedule of recurring fee since the other recurring fees are for period that haven't occurred yet. Thus, the system accepts only 2 as recurring fee and throws an error saying the amount entered is greater than expected.

For more scenarios and examples, please look up documentation available here.

When you have typed all collection data, click Preview to review your work. All values that you changed from their expected amount appear in red.

7. If you need to make changes, click Edit Data, make the changes, and click Preview again.

8. When you are satisfied with the collection data, click Submit.

Applying misc charge or misc penalties to loans after payment has been made

It is possible to apply misc charge or misc penalties to loans after payment has been made. Loan repayment schedule will be recalculated like on screens below:

After applying misc penalty (amount = 30), repayment schedule will be recalculated like on screen below: